Menu

On the below tax, surcharge is applicable at following rates, based on total income: (flat rates) Up to 50 lakh – Nil, 50 lakh to 1 crore – 10%, above 1 crore – 15%

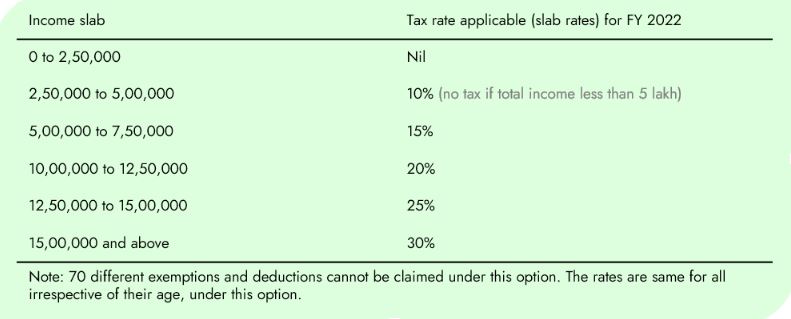

On the below tax, surcharge is applicable at following rates, based on total income: (flat rates) Up to 50 lakh – Nil, 50 lakh to 1 crore – 10%, 1 crore to 2 crore – 15%, 2 crore to 5 crore – 25%, 5 crore and above – 37%

Partnership firms and Limited Liability Partnerships (LLP) are taxable at 30%. There are no tax slabs or basic exemption limits for these entities. There’s no alternate tax regime for these entities. On the above tax, surcharge is applicable at following rates, based on total income: (flat rates) Up to 1 crore – Nil, Above 1 crore – 12%

On the corporate tax services, surcharge is applicable at following rates, based on total income: (flat rates) Up to 1 crore – Nil, 1 crore to 10 crore – 7%, above 10 crore – 15%, if opted for 115BAA or 115BAB – 10%

Foreign companies are taxable at 40%. There are no tax slabs or exemption limits for these entities. There’s no alternate tax regime for these entities. On the above tax, surcharge is applicable at following rates, based on total income: (flat rates)

Up to 1 crore – Nil, 1 crore to 10 crore – 2%, above 10 crore – 5%

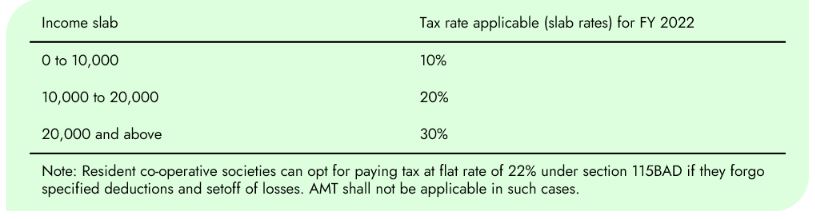

On the below tax, surcharge is applicable at following rates, based on total income: (flat rates) Up to 1 crore – Nil, above 1 crore – 12%, if opted for 115BAD – 10%

Note: Higher education cess at 4% on the amount of income tax and surcharge, is applicable to all taxpayers.